Accept crypto with CoinGate

Insights, product news and real crypto use cases

How to verify a merchant account? (FAQ)

If you are here, we expect that you intend to set up a CoinGate payment option at your enterprise. However, for that to happen, first you must verify your merchant account. This is a guide to help you achieve it easier.

Before you can start the verification, first you need to be sure whether you want to register as a business or a trader. It will determine what kind of documents we will ask of you.

For example, if you are a business owner who wants to implement cryptocurrency payment methods in your store, you must create a business environment by clicking on the “Create a Business Account” button in the right corner of the dashboard and proceed with the instructions written below.

However, if you only intend to buy or sell cryptocurrencies from a personal account, you can skip this article and proceed with trader verification instead.

Learn how to verify your account as a trader

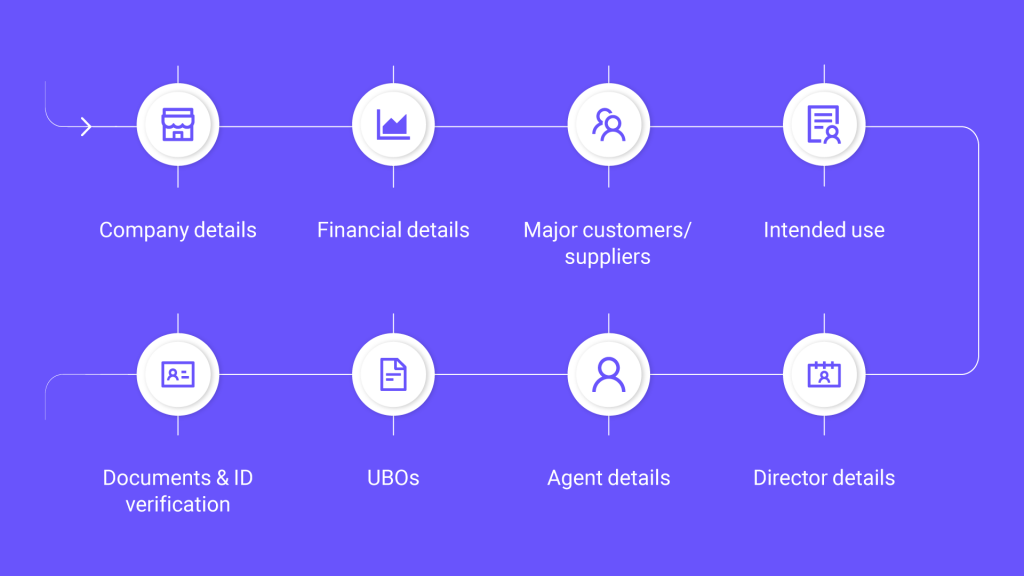

In this article, we will introduce you to the most common documentation required from merchants when passing the full KYC process, cover the most tricky parts, as well as guide you through the whole journey step-by-step.

Alternatively, you can choose to apply for a business Trial account which allows companies to use CoinGate merchant tools (API, plugins, billing, etc.) and trading services with less KYC required than usual.

But first, let’s take a second to understand why verifying your identity is crucial for using our payment processing services.

Why do I need to verify my identity?

We ask you to provide your ID (as a managing director or authorized agent of a company) so we could make sure that all of our vendors are legitimate and we are not serving criminals. All is done according to international law like the 5th AML Directive that we, as a company, have no choice but to follow.

Otherwise, we couldn’t provide our services as it would put our company and our clients in jeopardy. In other words, there is no way around it if you wish to access merchants tools and fiat settlements with payouts to a bank account.

There are two key things we have to know before providing the service:

- Who is this person or company that wants to use the service;

- What is the purpose of using the service?

All our customers go through live ID verification using the Onfido platform.

What documents do you require?

It all depends on the type of business you run or represent. Generally, companies have to provide these documents:

- Business Registration (also known as Business registration document/certificate);

- Article of Association (AOA, also known as Constitution, Memorandum, Articles of Incorporation);

- Photo ID Document issued by the government (preferably the International Passport or ID card).

According to the local Lithuanian laws, this is the information that has to be shown on the document for us to consider it as a valid ID:

- Name and Surname;

- Photo;

- Nationality or Citizenship;

- Date of Birth or Personal Code;

- Signature.

IMPORTANT! All required documentation must meet these conditions:

- All paperwork must be in English, and any translations must be notarized.

- Everything must be sorted out by the director of a company or authorized personnel. POA is required if acting on behalf of the director or company.

- All paperwork must be official meaning it has to be stamped and/or signed, depending on the local laws of a customer.

Documents provided in any other format will be immediately rejected.

Additional documentation – why and when do we require it?

Based on the structure of your company, we might ask for more additional documentation to officially determine who the natural person/individual(s) is/are that own(s) controlling share ownership of the company. For example:

- Generally, the AOA or Business Registration does not include a reference to the shareholders. If the documents mentioned above do not show who the director(s) is/are and how the shares/control of the company are/is divided, you will have to provide a stock/shareholder registry.

- The documents have to be provided by the director of a company. In case someone other than the director of the entity is filling out the verification form and passing through live ID verification, then we will ask for a Power of Attorney (POA) proving the “agent” has the authority to act on behalf of the director.

- If there are additional shareholders, the IDs (copies) of any holding more than 25% must also be provided. Otherwise, you may also provide a link to a publicly available registry which confirms the ownership.

- If the company that goes through the verification belongs to another entity, we require the Article of Association (AOA) of that entity and the document listing all of Ultimate Beneficial Owners (UBO). Companies that have more than one UBO also need to provide a stock/shareholder registry.

- If the company requires a particular license to operate, we will ask for a copy of said license.

How do I start verifying my business?

To start the verification process, switch to your business environment by clicking your name in the right corner of the dashboard and selecting the already created business account.

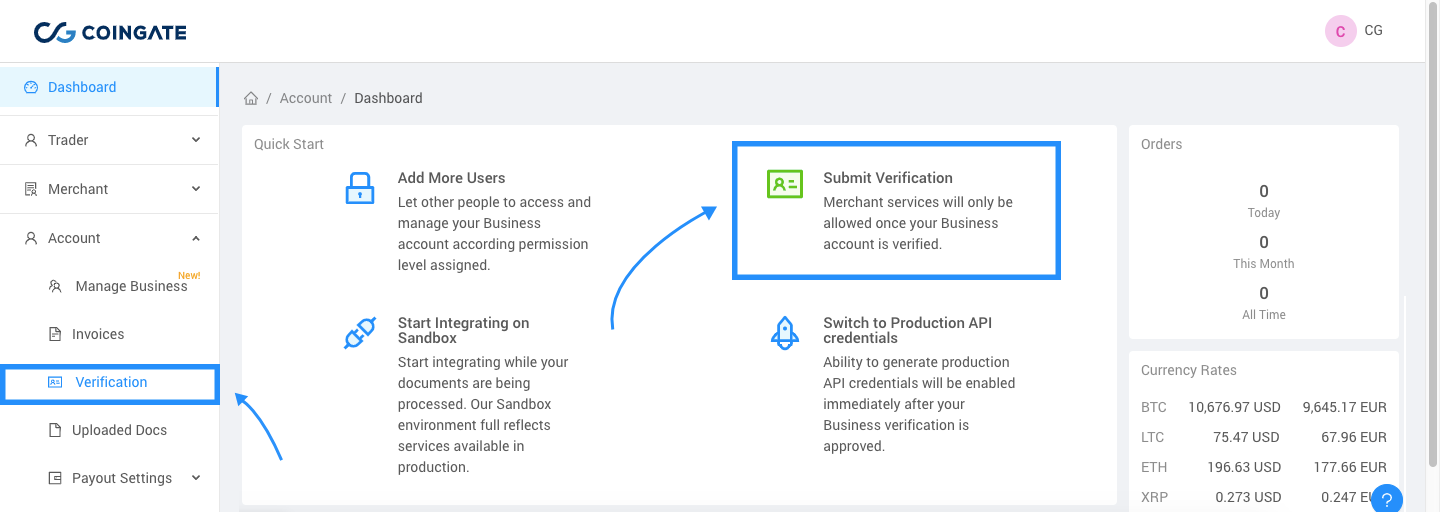

If you have not created your business account yet, click the “Create a Business Account” button, fill in the necessary fields and proceed further. Then, go to the “Account” tab and click on the “Verification” button, or proceed to this page.

Once there, take some time to read the presented information block. It goes through some crucial information you need to know before beginning, so we suggest not to rush and to read it carefully.

When ready, click the “Continue” button and start the verification. What kind of documents we will ask of you will depend on your next choice.

First, you will have to select whether your company is a Sole Proprietorship, Partnership, Incorporated, Government Organization, or Non-Profit, as well as whether you are the managing director of a company or a representative.

Next, follow the steps as shown below:

ID verification

The last step involves uploading your ID document to the Onfido system.

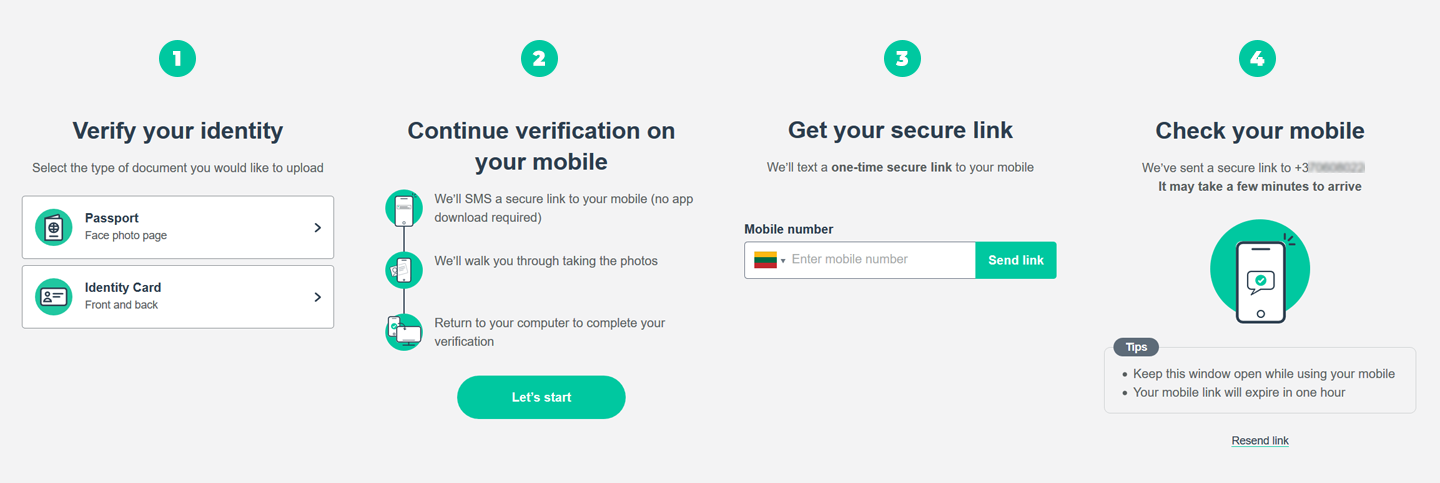

Click the “Verify Trader” button and choose the type of document you will upload. You will see a notification window informing that the verification process will begin, and for that, you need to have a mobile device.

Click “Let’s start” and provide your phone number. You will receive SMS with a secure link to the verification page. Open it, and the web app for verification will pop up. The process does not require you to have an Onfido app installed on your phone.

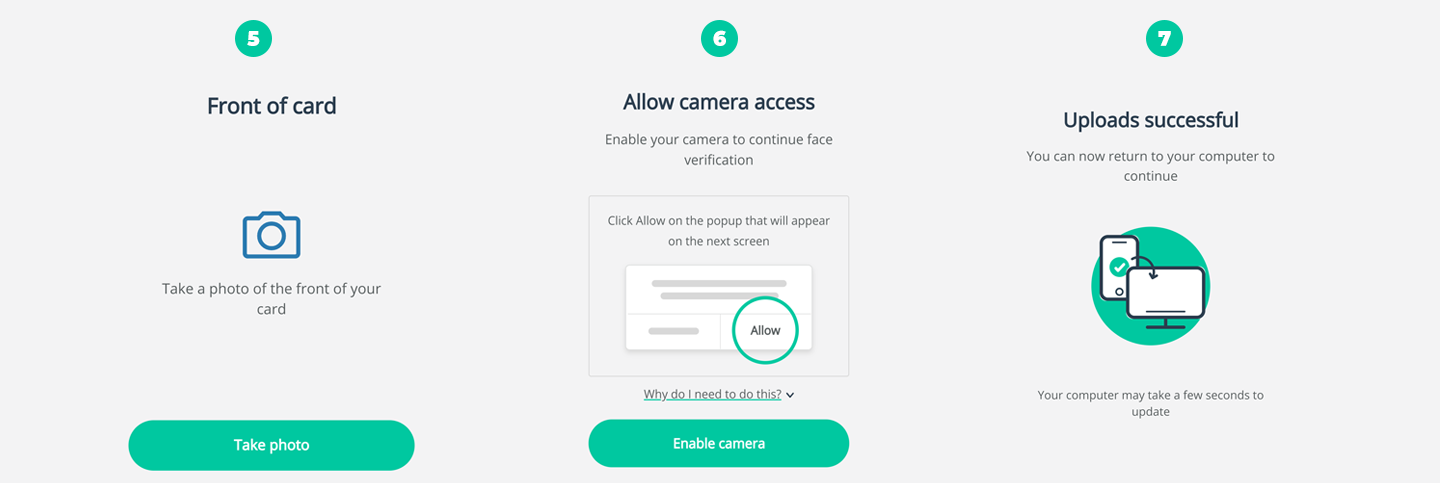

It will ask to take a picture of the front of your ID. When taking a picture, make sure it is clear and has no blur or glare. You will be able to check if the quality is good enough. If not, the system might reject your ID!

When done, the same process repeats for the back of the ID. The last step is a live face verification. For that, you will need to use the camera on your device. Click “Enable Camera” and take a selfie. Make sure that all your face fits in a circle. If the picture is of good quality, submit it.

You will see a confirmation window saying that the upload is completed. Now, return to your CoinGate account, click the “Submit Verification” button and that’s it!

Things to keep in mind

Sometimes, merchants can encounter unexpected issues, especially if the provided documents are lacking crucial information, or are not official, etc.

Here are a few things to keep in mind while preparing the necessary paperwork:

- Unfortunately, we have no way to verify the authenticity of digital signatures nor has any guidance been issued by our local regulator on how to deal with them. As such, we can only accept scans/photos of documents. Whoever has the authority to do so must sign and/or stamp the documents.

- At the beginning of the verification, we will ask you to provide a valid website address of your business. In case you don’t have one, or you intend only to set up a payment button, then simply explain this in the “Main business activities” section of the form. However, if your website is not up yet, then we will not be able to complete the verification until we have reviewed the live site.

- If your company doesn’t have any Major Partners to list, you will have to provide another document justifying your business activity, such as paid bills, commercial agreements, receipts, etc.

What happens with provided sensitive data?

All the documents we ask for are encrypted and protected according to the guidelines of the General Data Protection Regulation (GDPR) and will be used only to identify the client and justify the planned activities.

Failure to protect our customer’s data would result in extreme fines for our company that can reach up to 20 million euros, or 4% of the total worldwide annual turnover, as well as lost reputation and even clients’ mistrust. And we don’t want that!

Read more about the GDPR from our CEO Dmitrijus Borisenka

What countries do you support?

You can find a list of supported countries here.

Although it’s worth noting that the list is always changing. It depends on each country’s local laws, the risk level of fraud, terrorism or money laundering, and other significant reasons.

Have any issues or questions?

If you still have any questions or issues regarding the verification process, feel free to scout for answers on our knowledge base or contact CoinGate support team at support@coingate.com.

For solving issues related to the verification through the Onfido platform, please proceed here.

Here are more articles from CoinGate that might be relevant to you:

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.