Crypto Payments, Educational, Getting started

How To Use Bitcoin? A Helpful Guide For Newbies

Last updated: May 25, 2022 9 min read

Vilius B.

Getting familiar or, even better, comfortable with bitcoin can take you a long way, assuming that the most popular cryptocurrency in the world will remain no less relevant and will continue to pave the way for the next-generation financial structures.

As of now, it seems that bitcoin is not going away anytime soon or likely ever. On the contrary, the momentum it carries implies that the King of crypto is here to stay, and the best thing you can do is learn how to use it.

Some might say it’s a steep learning curve, and it’s true – many questions need to be answered before one starts to wrap his head around this entirely new breed of assets.

What do you need to start using bitcoin? What is crucial to understand about bitcoin before buying it? How do you obtain and secure it? Is there a way to spend bitcoin, and where?

We will answer all of these and other frequent questions with the aspiration to bootstrap your lifelong bitcoin journey and prepare you for the imminent future, all in our best effort.

Just know that you don’t need to understand bitcoin deeply to use it in your daily life, just like you don’t need to understand how Twitter or YouTube works. But it’s healthy to know at least something, and that’s what this article is all about.

So what is bitcoin, anyway?

To quote the famous Bitcoin whitepaper written and published in 2009 by a mysterious figure known only as Satoshi Nakamoto, Bitcoin is “a purely peer-to-peer version of electronic cash (that) would allow online payments to be sent directly from one party to another without going through a financial institution.”

But that’s just a glimpse of what it’s supposed to be. The idea of the Bitcoin network was conceived in the aftermath of the financial crisis of 2008 in hopes of providing humanity with the means to transfer money without being dependent on financial institutions or governments and protect wealth from the never-ending inflation (or collapse) of government-backed currencies.

With all that in mind, the Bitcoin network was designed using blockchain technology to intentionally be predictable, decentralized, permissionless, censorship-resistant, and immutable.

On top of it, bitcoin as a currency unit also emits all the properties of regular money: it’s divisible, portable, durable, acceptable, limited in supply (scarce), fungible, and liquid, among several other unique features. As a result, there’s no reason why it can’t be used to pay for goods and services just like regular cash, as long as merchants accept it for payment.

Today, bitcoin has proven itself a viable alternative to regular currencies and many traditional financial instruments. It continues to be adopted even on a national scale in several countries as an official legal tender.

The importance of bitcoin in today’s world

So how come countries such as El Salvador, Panama, and the Central African Republic already made bitcoin their national currency? Why do companies like MicroStrategy and Tesla pour billions of US dollars into bitcoin without ever dumping or planning to dump it back into the market? What’s the catch here?

Why do countries use bitcoin?

As it pertains to the countries above that have adopted bitcoin over the past year, the reason is relatively simple – to become less reliant on foreign national currencies, such as the US dollar.

It is especially relevant for developing countries that have weak currencies and are much more vulnerable to alien market changes that could lead to rampant inflation, as seen many times in the past in countries like Zimbabwe or Venezuela.

By adopting bitcoin as a legal tender, such countries immediately become part of a global economy and are less influenced by local market conditions, questionable political decisions, or economies of other countries.

In addition, bitcoin provides inclusivity for businesses and individuals to participate in the financial landscape without relying on traditional banks and financial service providers.

Why do companies use bitcoin?

Recently, more and more companies began adding bitcoin to their balance sheets as a diversification strategy.

The business intelligence firm MicroStrategy boasts of the largest allocation to bitcoin. Today, the company has approximately 125,051 BTC on its balance sheet. Michael Saylor, MicroStrategy’s Chairman & CEO, justifies this move by providing several compelling arguments favoring bitcoin as a superior asset class.

To briefly sum up M. Saylor’s convictions, bitcoin’s fundamentals provide means to securely store and grow wealth long-term better than any other existing asset (including gold) and, as a result, counter the adverse effects of the inflation of the US dollar.

For a company that has a problem of billions of US dollars just sitting idle on a balance sheet, bitcoin and its scarcity serve as a lifeboat that can safeguard it from slow, inevitable diminishing of its value, as long as one doesn’t mind bitcoin’s short-term volatility.

Companies are also becoming keener to accept bitcoin payments for several other reasons. Reasons are as follows:

- Businesses can receive payments with no delays from any corner of the world;

- They also cut several unnecessary middle-men from the payment process;

- Businesses also collect and share fewer data about their customers;

- Accepting bitcoin helps to save money on transaction and banking fees;

- Companies do not have to worry about fraudulent chargebacks on purchases when accepting bitcoin;

- By accepting bitcoin, merchants can attract a broader spectrum of customers;

- Offering to pay with bitcoin can give you a competitive advantage over your competitors.

If you’re interested in learning more about the benefits of bitcoin payments for businesses, read this article.

But what’s the use of bitcoin for regular people like you and me?

Benefits of bitcoin for a casual person

Like companies that utilize bitcoin as a countermeasure to inflation, regular folks can do the same thing – accumulate hard-capped BTC using an ever-inflating fiat currency and, hopefully, increase your savings more effectively.

Besides that, there are more benefits that bitcoin brings to the table, especially when used as a payment currency.

People who use bitcoin to buy goods and services can retain anonymity when paying. Bitcoin transactions do not disclose any personal information about the payer and don’t require 3rd party services to execute the payment.

It’s also faster and cheaper to pay with bitcoin rather than wiring money internationally through a bank or money transfer services. And, if one uses Lightning Network to transfer bitcoin, the transactions become immediate and cost close to nothing to execute.

Lastly, bitcoin enables you to hold an immutable, unseizable asset and allows you to be responsible for your own money without depending on banks or other legacy financial institutions.

What do you need to get involved in bitcoin?

Becoming part of the bitcoin community poses no real challenges. It’s as simple as creating a wallet, buying bitcoin, and storing it safely.

Choosing a bitcoin wallet

There are countless various wallets that you can use. As long as you own your private key (a.k.a. the only thing that can allow access to bitcoin that the wallet stores), you’re good to go. One of the main differences to look out for is whether the wallet is considered hot or cold.

In essence, wallets that are connected to the internet are called hot wallets. On the contrary, all wallets kept away from the Internet connection are considered cold wallets.

Hot wallets

Hot wallets are helpful for everyday use, like buying goods and services, sending crypto to friends or family, moving coins to an exchange, etc. These typically come in free and easily accessible software, such as a mobile app.

Cold wallets

On the other hand, cold wallets, or cold storage, are physical hardware wallet devices designed for far more secure, long-term BTC storage. Although anything can be considered a cold wallet – even a piece of paper with a private key written on it would be classified as such.

Learn more about types of hot and cold wallets.

Ways how to buy bitcoin

When it comes to acquiring bitcoin, it can be done in several different ways. Buying bitcoin is feasible with a bank account, credit or debit card, or by exchanging other cryptocurrencies for it.

CoinGate offers every single method to buy bitcoin and other cryptocurrencies directly to the wallet of your choice.

Learn more about buying bitcoins on CoinGate.

Storing and securing bitcoin

Another important aspect of choosing a wallet is understanding whether it is custodial or non-custodial.

A custodial wallet refers to a type of wallet where a third party holds private keys on behalf of users and is considered less safe. On the opposite side, non-custodial wallets allow users to hold their private keys on their own.

For any bitcoin user, it’s recommended to have a cold wallet for long-term storage and a non-custodial hot wallet for daily use.

Custodial wallets (such as exchanges) are usually transitory and are not recommended to store wealth for a long time. Being centralized, they are vulnerable to multiple risks that non-custodial wallets are not, and wallet service providers always have an option to seize your assets if deemed necessary.

As the famous saying goes, ‘not your keys, not your coins’, so be mindful.

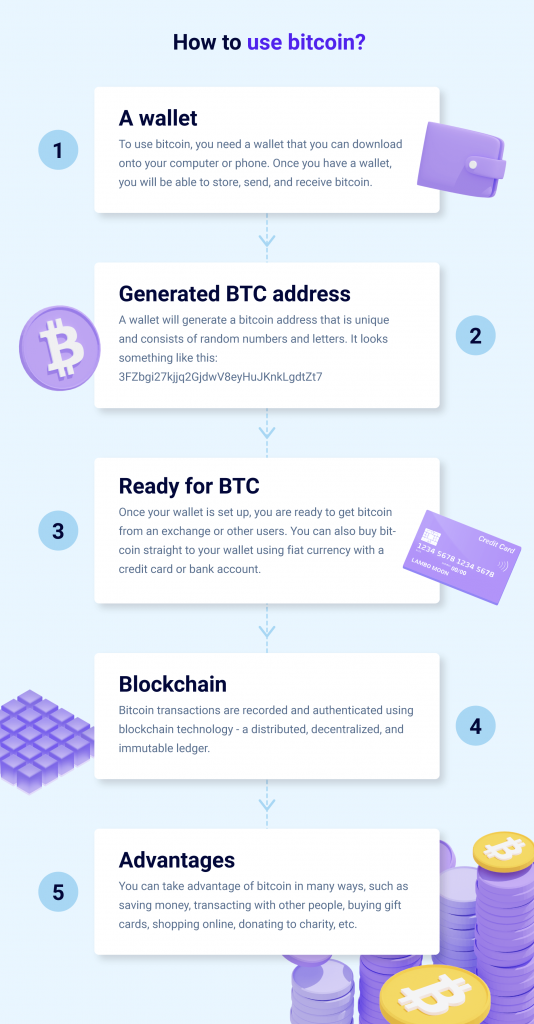

How and where to spend bitcoin?

Once you have your bitcoin in your wallet, it’s up to you what to do next. The good news is that you can spend it at any time for pretty much anything you can imagine.

Numerous companies worldwide accept bitcoin for payments. You can find plenty of such merchants on the CoinGate merchant directory.

However, even if a merchant doesn’t accept bitcoin, you can always buy a branded gift card with bitcoin from the CoinGate gift card store and then spend it where you want. Choose from hundreds of gift cards from the most popular brands in the world and enjoy buying anything and living on bitcoin.

Not sure how to make a payment with bitcoin? Here’s a step-by-step guide.

Can I convert bitcoin back to cash?

You can sell bitcoin for EUR or GBP on CoinGate at any time and receive payment to your bank account. Log into your account and go to Trading > Buy & Sell, then click the ‘Sell’ button, or click here.

Written by:

Vilius B.

Knows as much about VPN as it is healthy for someone who isn't a VPN developer. Testing more text to see how it looks like. And a little bit more toblerone and on and on.

Knows as much about VPN as it is healthy for someone who isn't a VPN developer. Testing more text to see how it looks like. And a little bit more toblerone and on and on.

Related Articles