Accept crypto with CoinGate

Insights, product news and real crypto use cases

How can stablecoins help traders and companies in dire situations?

The vast majority of people that embrace cryptocurrencies, whether they are spenders, traders or crypto-friendly businesses, still have to heavily rely on banks to carry out day-to-day operations.

But what can be done if a bank decides to seize your activities solely because you involve cryptocurrencies in your daily life?

The reality is that every region and every country has its own rules and understanding about cryptocurrencies. On top of that, all banks perceive blockchain-enabled technologies in a different light.

If that’s not enough, the ever-changing regulatory policies (or lack of them) across the globe doesn’t make it easier to deal with industry’s challenges (however, we’re making excellent progress here in Europe).

Depending on these and many other circumstances, sometimes people get into disputes with their banking providers about whether digital assets are legit enough to be entangled with traditional banking operations.

Unfortunately, in rarer cases, these situations can lead to unpleasant consequences, such as a needlessly frozen bank account.

Of course, it’s not the only case scenario of how a bank can suddenly put a personal or even business account into peculiar limbo. But whatever the reasons might be and whatever inconveniences they might cause, here we’ll focus on solving two pressing problems:

how to proceed with those cryptocurrencies that you wanted to turn into fiat and place into that now-frozen bank account; and, more importantly, how NOT to lose money due to price volatility of cryptocurrencies in the meantime.

The untapped potential of fiat-pegged stablecoins

We’ve talked about various types of stablecoins on our blog before. If you’re not familiar with the term, we recommend taking a few minutes to get a grasp of it.

To shortly summarize, stablecoin is precisely what the term implies – a crypto-asset built to maintain a stable value. And yet, it retains all the properties that make cryptocurrencies tick as they do, such as strong security, high transparency, low-cost, and fast transaction.

Right now, these non-volatile digital currencies, especially those pegged to fiat currencies like Euros or US Dollars, are indeed being taken for granted, given the opportunities and flexibility they can provide.

So, let’s create a fictive problem and imagine any crypto-friendly merchant who, for whatever reason, suddenly lost his banking privileges and cannot exchange part of his crypto earnings to fiat. The unpleasant situation staggers his business, which also becomes vulnerable to probable crypto price fluctuations.

What role can stablecoins play here? If to take it one step further – what other good qualities do stablecoins (fiat-pegged or not) have to offer?

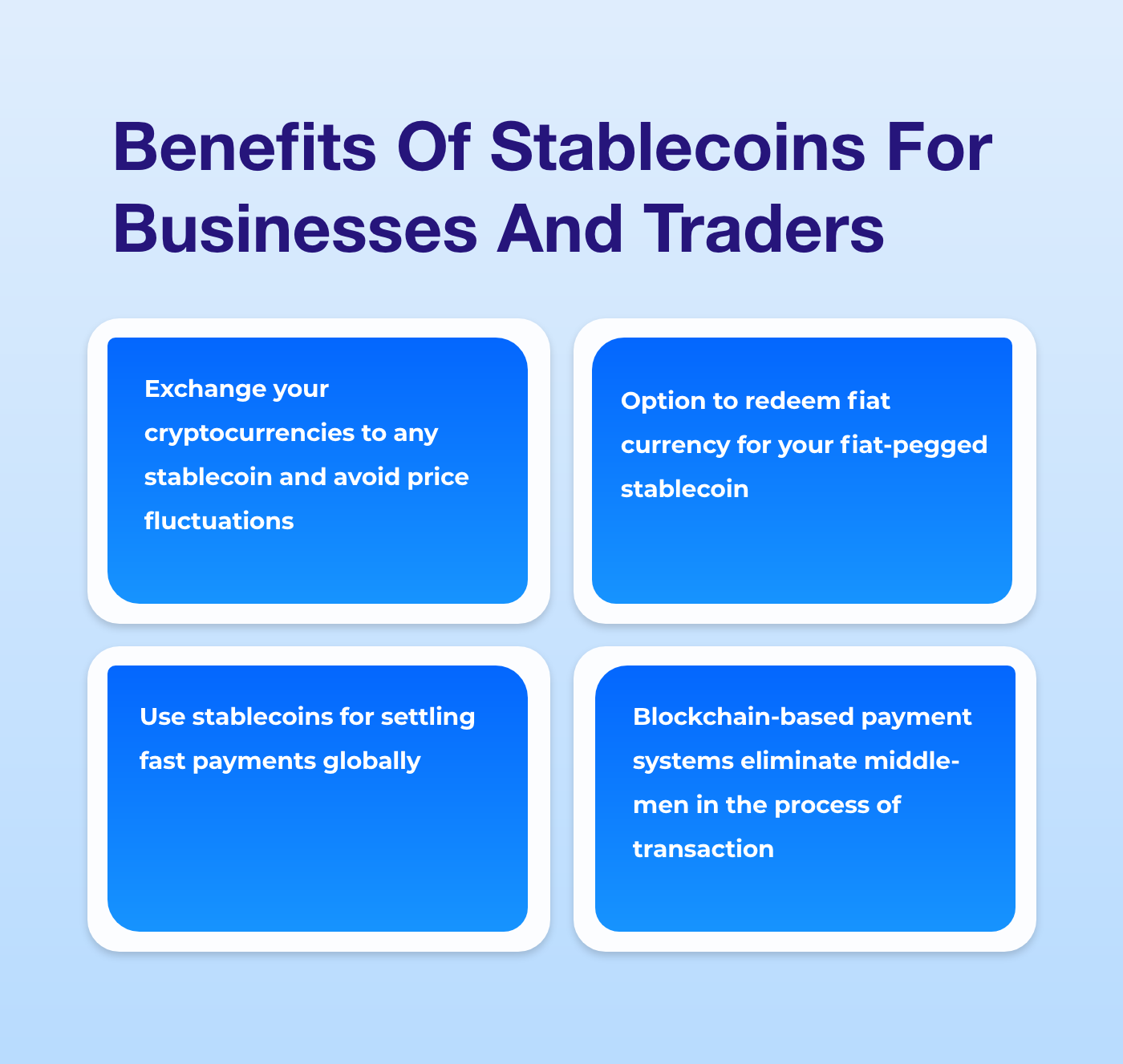

Ways stablecoins help businesses and benefit traders:

- You can exchange your cryptocurrencies to any stablecoin and avoid price fluctuations. Most digital assets are easily tradable for stablecoins on exchanges such as Binance or Bitfinex. Exchanging volatile coins that you don’t want to stablecoins gives you peace of mind during high price fluctuations and plenty of time to sort out unexpected issues with banking partners.

- You have the option to redeem fiat currency for your fiat-pegged stablecoin. No matter which fiat-pegged asset you decide to use, you can request a fiat withdrawal to any viable IBAN address through the entity that issues particular stablecoin, although additional terms apply.

- You can use stablecoins for settling fast payments globally. Why make an international wire transfer that takes from 1-3 days to go through when you can achieve the same result immediately using stablecoins? Remember – on-chain payments do not abide holidays, working hours, location or interference from 3rd parties – meaning all transactions are always near immediate.

- As already hinted, blockchain-based payment systems eliminate middle-men in the process of transaction, and stablecoins are no exception. Payments with stablecoins are cheaper, faster, and pose no risk of intrusion of a service provider.

Naturally, such privileges do not come without a ruleset, so keep in mind that using regulated fiat-pegged stablecoins also requires you to pass the verification process (that is if you wish to get access to the fiat bridge).

Currently, the most popular choices for fiat-backed stablecoins in the market are TrueUSD (TUSD), Tether (USDT) and Paxos Standard (PAX).

Does CoinGate provide stablecoin-related services?

CoinGate users do have an opportunity to include stablecoins in their financing habits.

Currently, we offer two ways of how you can take advantage of them. However, during the year 2020, when we will introduce account balances, we also will vastly expand in terms of what more we can offer to our customers regarding stablecoins.

Here’s what we can do right now:

- We offer cryptocurrency settlements to fiat-pegged USDT and crypto-backed Dai stablecoins, meaning you can convert all or portion of collected funds to one of these options and withdraw them to a preferred wallet or exchange.

- Our payment solution also allows accepting Dai, USDT and StableUSD (USDS) payments, as well as keeping these currencies in the original form when received.

In case you have a verified business account and wish to adjust your stablecoins’ settlement options, jump straight to this article for further guidance.

- Customers have an option to buy Dai stablecoin by making SEPA bank transfer or paying with mobile balance.

- Lastly, you can sell your currently owned USDS or Dai to us for Euros that go straight to your preferred bank account.

Hopefully, our customers will never have issues discussed in this article. But, in case something goes south, it is always good to know a few alternatives you can use right away, and stablecoins are undoubtedly a way to go. Keep that in mind!

Do you think stablecoins could help your business achieve more in the long term? Let us know right here on Twitter!

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.